Charles Calomiris has a splendid WSJ review of a great book, "The Myth of American Inequality" by by Phil Gramm, Robert Ekelund and John Early.

It is a "'a truth universally acknowledged,' according to the Economist magazine in 2020" that

little progress has been made in raising average American living standards since the 1960s; that poverty has not been substantially reduced over the period; that the median household’s standard of living has not increased in recent years and inequality is currently high and rising

Most of all the last one.

All of this is false. Most of all the last one.

1) Income. The central jaw-dropping, astonishing fact: The statistics you read about income and income inequality ignore taxes and transfers. By doing so, of course, they create a problem that is immune to its purported solution!

Especially on the low end, transfers including in-kind transfers (housing, medical payments, etc.) are a huge part of consumption and properly measured income.

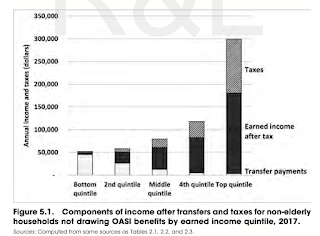

Pay especially attention on the left hand side of the graph. Actual income is essentially flat in the first three quintiles of earned income.

Gramm Ekelund and Early are fond of quintile bar graphs, like this one. The bars are pretty flat from the lowest to third decile, and transfer income is a big part of the story.

More, do just a little bit of adjustment for household size. Single person households are obviously going to have less income than two-earner households. Households with children have less per capita income, but people with kids may be more likely to work. How does it work out? In per capita terms (middle) actual income, including taxes and transfers is almost completely flat in the first four deciles.

2) Work. Well, a good anti-capitalist might say, this just proves the point. Look how dreadful the distribution of income before taxes and transfers is, and admittedly getting wider. Raw capitalism is destroying the poor, and only the maginficence of the welfare state is keeping them going. One answer might be, ok, but let's at least measure how we're doing rather than just keep publishing the false statistic as if we're doing nothing.

But there is a better answer. Why is it that the pre-transfer earnings of the lower quintile are so low, and pre-transfer inequality getting larger? Because they aren't working.

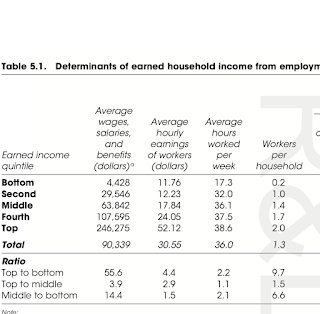

Average hours per week 17.3 vs. 38.6; workers per household from 0.2 to 2.0. Sort of mechanically, if you don't work you don't have earned income.

Why has work collapsed in the bottom decile? Here we might have a big debate. $11.76 per hour (2017) isn't a lot. But the previous graphs certainly contain a suggestion worth pursuing:

The effective marginal tax rate in the lowest three quintiles is effectively 100%. Earn a dollar, and lose a dollar of benefits. Why work?

Gramm Ekelund and Early are careful, and don't make any causal assertions here. They don't really even stress the fact popping from the table as much as I have. But the fact is a fact, a nearly 100% tax rate + an income effect isn't a positive for labor supply, and the amount of work in lower quintiles has plummeted. This is a book about facing facts and this one is undeniable.

One might also complain that people don't value in-kind transfers. Medicaid is expensive to the government and awful. Government provided housing isn't great and it isn't where you might want to live. Gramm Ekelund and Early value transfers at cost. If $20,000 worth of Medicaid is only worth $5,000 to the recipient, there is a problem with Medicaid!

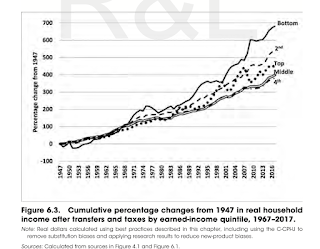

3) Time. The Standard Narrative says that things are getting worse over time, and people are stuck in their income bins. Neither is true. Actual income, after transfers, and properly accounting for inflation -- has not been stagnating or declining over time. One reason is, again, the simple failure to account for the enormous increase in transfers.

Again, the first three deciles are dramatic. The decline in earned income in the top is indeed worrisome but it comes as above from a decline in work. Discuss among yourselves where that comes from.

A second feature is that the CPI does a poor job of measuring living standards across long periods of time, because it doesn't account well for quality improvement and the fact that people shift consumption to cheaper items. Do you really want a small 1970s house, a Ford Pinto, and medical care that can't cure most cancers?

Bottom line, here is the fact:

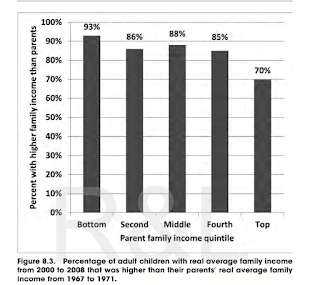

Oh, and being stuck is also not true. There is a lot of turnover of quintiles, and overall growth does help even those who stay in the same quintile. And, as you might guess, the most likely to underperform their parents are the kids of the super-rich. Elon Musk's kids are very unlikely to do as well as he did, and there is a lot of luck in being super rich.

There is lots, lots more in the book, including the fortunes of the super-wealthy.

As Calomiris sums up,

This book is written in straightforward American English, not in economic think-tank jargon. It shows clearly how each element of the analysis (taxation, transfers, inflation adjustment) contributes to its conclusions. Graphs and tables are comprehensive and comprehensible. The style is lively and lucid...

The analysis probes deeply to demonstrate the robustness of its conclusions..

Most important, the authors don’t clutter their analysis with contentious approaches to measurement, and they limit their policy recommendations to those that flow self-evidently from the facts they document. It is encouraging that three disparate economists can together write an objective book about the measurement of living standards, poverty and inequality without engaging in partisan advocacy that undermines their findings. (“While we each have our opinions and political views,” writes Mr. Gramm in a preface, “we share a desire to get the facts straight.”)

My sense is that the book is not having the impact it should. Economists love complex empirical work, and the mainstream media does not, ahem, appreciate a book that so transparently demolishes the Standard Narrative.

It's a great read.

from The Grumpy Economist https://ift.tt/RljQOb7

0 comments:

Post a Comment