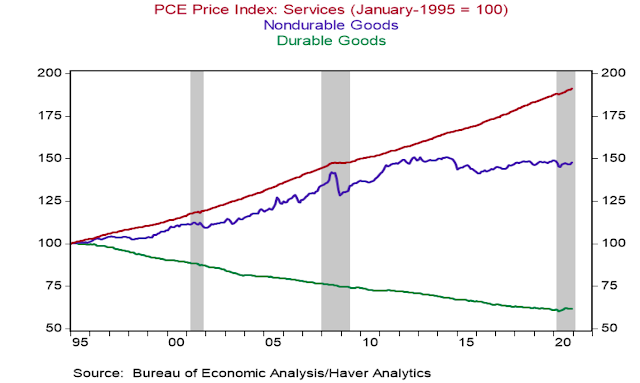

In analyzing whether inflation is coming, Mickey Levy at Berenberg Capital passes along the above graph. These are price indices, so the upward or downward slope measures inflation. Is there inflation? That depends on whether you ask durable goods or services.

Why are we experiencing durable good deflation, and will it last? Part of the answer is quality adjustment:

The Bureau of Economic Analysis' (BEA's) official inflation indexes are based surveys of product prices that are adjusted for estimates of quality improvements in new products and services.

Quality adjustments have had a pronounced impact on the PCE price index of durable goods, which has declined 38% over the last 26 years, despite sizable increasers in many pcorudct prices... (For example, the average sticker price of an automobile has roughly tripled since the mid-1990s, but, because of estimated quality adjustments, the BERA's PCE price index of automobiles and parts has risen only 9% since January 1995.)

That raises an eyebrow. Yes, a 2021 computer is more than three times better than a 1995 computer, so if you buy it at about the same price, which you do, we can call that deflation. Is a 2021 car really three times better than a 1995 car? Hmm. However, most economic analysis suggests that the BEA understates the quality improvement of new goods, so there is actually more deflation than it seems here.

Mickey notes

advancements in the distribution of goods has reduced prices of goods and services.

So part of the story is Wal-Mart and Amazon.

Mickey attributes the decline in durable goods prices to productivity improvements. But if you run down to Home Depot and look around the selection of power tools (guilty habit), however, a glaring contributor has to be China, as well as innovation. Electric motors got cheap, yes, but you can only buy a pressure washer for $50 because of China. That source of price decline may not last.

Services?

... Quality adjustments in services is much more difficult to measure (i.e. medical services) and in meany services, quality has not improved much over time ..the PCE price index for services has risen at an average annualized pace of 2.6% since the mid-1990s, and 2.1% during ...2009-2019

I push back a little. If it is difficult to measure, how do we know quality has not improved much over time? But it is true that medical services, paid and provided by the most arcane system devised by human mind, do not bear the marks of the sort of innovation and efficiency gains we see in durable goods. The quality gain is mostly scientific advance.

So, looking at inflation, roughly 70% of the price index comes from services. Of that about half is housing services -- yes, the BEA counts housing as a service, not a durable good. Here the BEA tries to figure out the rental value of houses and quality adjust -- and health care where who knows what the prices mean. Many prices are either determined by Medicare or Medicaid, or insurance negotiation which specify those prices plus a percentage. Is an hour of a lawyer's time better than it was in 2010? An hour of university instruction? (No. Worse, I would guess in the humanities, better in computer science.)

I hope I am unsettling you about just how much we really understand about inflation. That the Fed is obsessing over 1.7% vs. 2% seems a bit strange. Rather than look at a few tenths of a percent variation over time, if we look at variation across goods categories, across methods of accounting for quality change, across space -- the price level in Palo Alto seems about 3 times higher than it is in, say, Reno -- and across people -- the stuff that people with lower incomes buy has gotten a lot cheaper, and the stuff that wealthy people buy has gotten more expensive, a fact our inequality worriers might note some day -- we might get a truer picture of just how fuzzy our measurements are.

I don't know what happens to inflation in the short run. But if this graph is true -- services are inflating 2.5%, really are not having much quality improvement, durable goods are deflating 1% due to continued quality improvement -- the long run means more inflation. As durable goods prices decline, unless people buy proportionally more of them, durable goods become a smaller and smaller part of the shopping basket. Then the CPI weights them less relative to services. We have already seen many goods become free such as maps. They then disappear from the CPI. Inflation then becomes the inflation of services only.

from The Grumpy Economist https://ift.tt/3qtr7o9

0 comments:

Post a Comment